Category Archives: CRYPTO

Update:

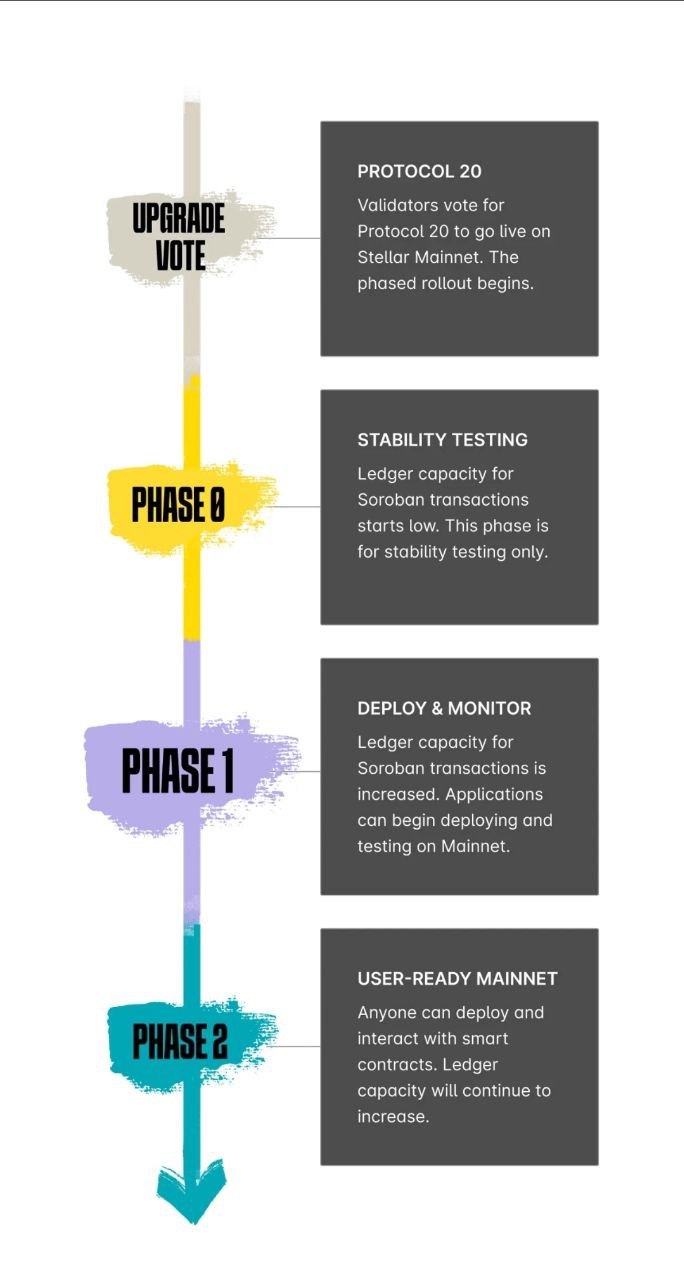

We have an update on Stellar Soroban Phase 2 test. It is complete.

Protocol 20 is about to move into high gear at this point.

* Upgrade on Pubnet March 12th

* Validator vote March 19th

* If all goes well, everything will move to public use

According to Stellar Developer’s discord, testnet has been updated to phase 2

💋💋 Red October goes missing POTUS Stage Set Sessions = US Cyber TaskForce. youtu.be/RS2HLC0sipA Egypt – The Nile, Exodus 8 3. Egypt has a massive Army. t.me/ETheFriend/4777 All countries East of Germany pull back the Iron Curtain. Turning on Germany & Switzerland. Before turning on England & Israel. t.me/Whiplash347/28477 Germany will join BRICS.

The UN Security Council will hold a meeting on Ukraine tomorrow, March 8

t.me/WW3INFO/35958

t.me/WW3INFO/35959

Here Comes The Sun/Son…

Sunlight Kills > Trump Admin Version 2

– youtu.be/VUI-ELCdjxo?si=Mq4zN6sql3kY33ge

– 2 days left until SHX GUARDIAN ICO closes.

💋💋Q897 Liquidity Events Regulation. Guardian Map, Crescent Moon t.me/Whiplash347/105184

“RAMADAN” in Ramadan they worship Daniel, 3 weeks in Daniel 10:2-3.

[Food off the shelves]

t.me/Whiplash347/27177

t.me/Whiplash347/71524

t.me/Whiplash347/81894

t.me/Whiplash347/82088

t.me/Whiplash347/127863

t.me/Whiplash347/184421

– First distribution SUKUK on March 9

♥️🌟🏆⬅️✅⬇️⬇️⬇️⬇️⬇️

Website Whiplash347official.com.

youtube.com/@WhipLash347Official

30 Languages. t.me/boost/Whiplash347

Planetbanknote.com 🌟🌟🌟🌟🌟

ENTER CODE “WHIPLASH347”

1️⃣5️⃣🔣 off til Sunday Sale & Free Priority Shipping. Same day shipping before 3pm EST! 💋💋 Currencies.

#LiveCashbacks 💥💥 #Channels

t.me/Whiplash347/205908

This sounds a lot like the phased approach for Protocol 20 that the SDF is supporting, “to ensure functionality and features are solid and secure for everyone interacting with the network.”

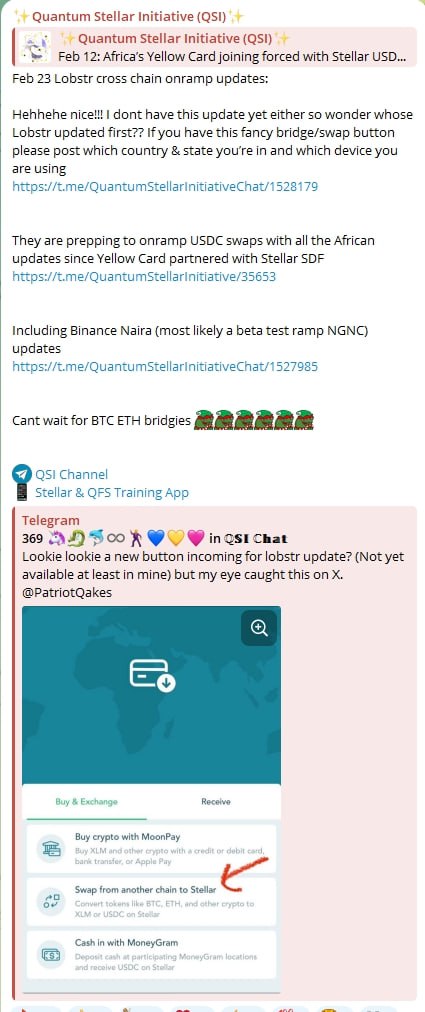

MAS’s XC platform is clearly integrating many of Stellar’s functionalities, including CAP’s and SEP’s. And they have been testing it for many months.

And with the Protocol 20 vote scheduled for tomorrow, what a perfect time to launch this asset, yay!! 😁 ✨