People overwhelmingly HATE Joe Biden

Holy shit!

ALL of Trump’s charges are based on the assumption that the 2020 election didnt have fraud. That it was a valid election.

So, basically all Trump has to do is prove there WAS FRAUD, right?

The Q post!!!!

Boom

Boom

Boom

Boom

(4 “booms”)

After the THIRD indictment, Trump said all he needs is ONE MORE INDICTMENT TO WIN HIS ELECTION!

HE ISNT TALKING ABOUT THE 2024 ELECTION!!!

HE’S TALKING ABOUT THE 2020 ELECTION!!!

THROW OUT THE CASE AND THROW OUT FANI WHILE YOU’RE AT IT!!

Kash Patel says that Fani Willis broke the law when she allowed the leaked indictment charges and was 100% lying at her press conference when she blamed the leak on the clerks. He says that the entire case should be thrown out!

“Donald Trump’s team needs to challenge the grand jury’s indictment in this case. It is unlawful. Therefore, the case in it’s entirety must be thrown out because the district attorney herself broke the law.”💥

Awesome interview with X22 Report!

Watch the full interview here

(https://rumble.com/v385nsf-kash-patel-right-wing-conspiracy-theories-are-true-its-all-about-to-boomera.html)ht @TheStormHasArrived17

It’s a land grab. 💯

Join Here ➡️@teamanons

🦅 🇺🇸 💪 🔥

Russian Chief of Nuclear, Chemical, and Biological Protection, Lieutenant General Igor Kirillov, on Zvezda today:

“They (US) have a policy of global biological control. They understood that by creating artificial biological crises, they can rule the world.”

Join Here ➡️@teamanons

🦅 🇺🇸 💪 🔥

BREAKING: Russia today claimed the US has begun preparations for a “new pandemic” by searching for virus mutations through the newly-established Office of Pandemic Preparedness and Response Policy (OPPR).”

@GeneralMCNews

The reason why their historical collaboration has taken center stage at the moment is because that is the same thing that enabled Stellar to gain access to the future plans of MoneyGram.

Needless to say, they were pretty impressed with what MoneyGram had the potential to do in terms of digital transformation and execution. That gave them the confidence to grab any opportunity which came their way.

Years later and the investment aligns with that historic judgment.

Stellar Development Foundation will now take a more active role in MoneyGram International. Possibly, an even more active role if another opportunity comes to light.

Stellar Development Foundation is now officially a minority investor, courtesy of the private transaction with MDF, short for Madison Dearborn Partners. The investment was rolled out of the Foundation’s own cash treasury.

This makes the investment one of its kind. Another option was to leverage the Enterprise Fund.

MoneyGram will use the funds to expand its digital business, explore the potential of blockchain technology, and find ways to grow the company.

The investment made to MoneyGram International has also granted the Foundation a spot on the Board of Directors. It also has leaders from the financial, technological, and payment industries.

Stellar has called this an exciting time for both companies, adding that there is definitely an opportunity for growth. Stellar and MoneyGram are now looking forward to the utilization of the investment and building more such partnerships in the future with the goal it puts Stellar Development Foundation a step closer to achieving equitable access to financial services.

GO STELLAR! 🙂🙂🙂

Amazon’s recent decision to adopt Ripple’s technology signifies the increasing acknowledgment and approval of cryptocurrencies as a valid method of conducting financial transactions. This move by the leading industry company can potentially push cryptocurrencies, particularly XRP, into common usage. Additionally, this partnership allows Amazon users to make seamless, speedy, and cost-efficient transactions.

Reactions within the cryptocurrency community to the Amazon-Ripple collaboration have been varied. While specific individuals perceive the partnership as potentially insignificant, referencing the current state of the announcement, others foresee the possibility of additional disclosures emerging soon. The exact details of the arrangement are still veiled in secrecy, creating a space for conjecture and eagerness.

The underlying goal of Ripple Labs is committed: to pave the way for a future where cryptocurrencies seamlessly coexist with traditional fiat money, reshaping global transactions.

Bright prospects lie ahead for Ripple and its native cryptocurrency, XRP. As this partnership sets the stage for a new era of financial interactions, Ripple could emerge as a dominant force in the ever-evolving realm of cryptocurrencies. 😁😁😁

The stage is set, and the world watches this transformative saga unfold to pave the way for a future where cryptocurrencies seamlessly coexist with traditional fiat money, reshaping global transactions. 😂😂😂

“The stage is set!” 🕺🕺🕺🕺

Story by Tronweekly

Coinbase Global Inc. has been authorized to directly sell cryptocurrency derivatives to retail consumers in the US. According to a company spokesperson, the offering will be launched within a few weeks.

Coinbase has been working to push derivatives for some time. It applied for National Futures Association (NFA) authorization almost two years ago.

In early 2022, it bought the FairX futures exchange, which was already registered with US regulators. Renamed Coinbase Derivatives Exchange, it currently directs traders to buy futures from third parties such as brokers.

But once it receives NFA authorization, Coinbase will be able to provide these same derivatives to users directly, initially through the main Coinbase app.

The company has recently introduced derivatives overseas. In May, it announced the launch of Coinbase International Exchange, which allows institutional users located in eligible jurisdictions outside the US to trade perpetual futures. According to the website, trading volume on the international exchange totaled $2.52 billion over the past 30 days.

Follow us on Telegram and Twitter

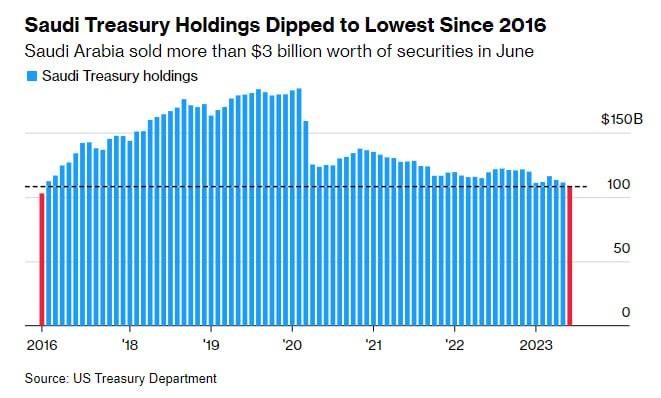

Saudi Arabia’s holdings of US Treasury bonds fell to the lowest level in more than six years.

The country sold more than $3 billion in US government debt in June, offloading the securities for a third consecutive month to bring its holdings to $108.1 billion, according to Treasury Department data. The neighboring UAE sold nearly $4 billion.

Echoing the sell-off, China dumped $11.3 billion in June, bringing it to the lowest level since mid-2009.

Japan and the UK were among the biggest buyers of what’s widely perceived as one of the safest assets to own. But their own economies are continuously pressured by a multitude of factors, and some experts believe that they can barely continue to buy at the same pace.

Falling demand for Treasuries could make it much harder for the US to continue borrowing money as it has historically done.

Follow us on Telegram and Twitter