It is more obvious every day that with the accession of Donald Trump to the presidency of the United States—I refuse to use the word “election,” because I am convinced that Trump was designated for this position by the “deep state” and the controlled media—a major world disaster is not only likely but probably inevitable.

Before proceeding, I would like to say something about my own background. I spent 32 years as an analyst with the civilian side of the U.S. federal government. I worked for the U.S. Civil Service Commission, the Food and Drug Administration, the Jimmy Carter White House, the U.S. Office of Consumer Affairs, NASA, and the U.S. Treasury Department.

During those years I took part in many high-level policy initiatives under seven presidential administrations, from Richard Nixon to George W. Bush. This included a massive conversion to electronic funds transfer for U.S. Treasury Department financial transactions, amounting to a multi-trillion dollar cash flow annually. After 9/11, my work included being part of a committee that developed a long-range plan for Treasury as part of the so-called “War on Terror.”

I can assure you that apart from what may have been the case in the distant past, today the government of the United States is not controlled by any elected official. Rather it is managed by a deeply entrenched bureaucracy reporting behind the scenes to powerful figures from the world of international politics and finance—some in the U.S., others not.

Since I retired in 2007, I have published several books and dozens of articles on public policy matters. One of my books, Challenger Revealed, was the definitive account of the space shuttle Challenger disaster, exposing multiple layers of cover-up by NASA, the Reagan Administration, and the Presidential Commission that was convened to examine it. Most of my articles have been published on the Global Research website out of Canada,

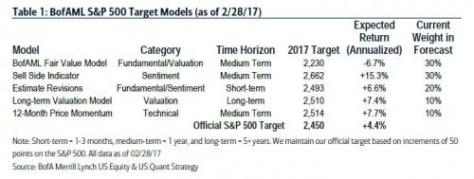

My next book was on monetary policy and titled, We Hold These Truths: The Hope of Monetary Reform. This book consisted of a history of the U.S. monetary system and an explanation of why that system should be changed radically to avert further disasters…

Source: Usury Based System: Towards a Worldwide Financial Disaster? | Economy