UPDATED: 11JUL21

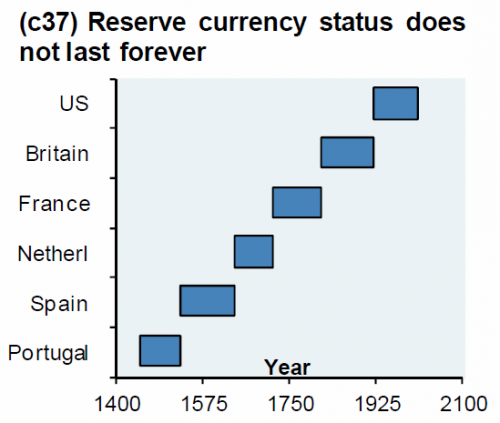

This is a financial paradigm shift of epic proportions! We are about to see a wealth transfer unlike anything we have ever seen before! You are positioned on the right side of history! Massive surprise coming in the next few weeks!!

The new global financial system is being built right in front of our eyes over the last couple of weeks! We are about to see the greatest transfer of wealth the world has ever seen!

**BEST CURRENT INTEL DROPS FROM: https://t.me/Whiplash347 **

MY NEW PATREON GROUP:

I have started a Patreon account to more easily deliver the latest tips and profit techniques that work for me in the crypto field. As this will reduce my advantage and profits, I have made it a pay service to compensate me for putting us all on a level playing field! We will get the coins before anyone else can! I made 5000% from the last 2 coins (DMH)released and my method guarantees that you will not get caught be a FAKE COIN.

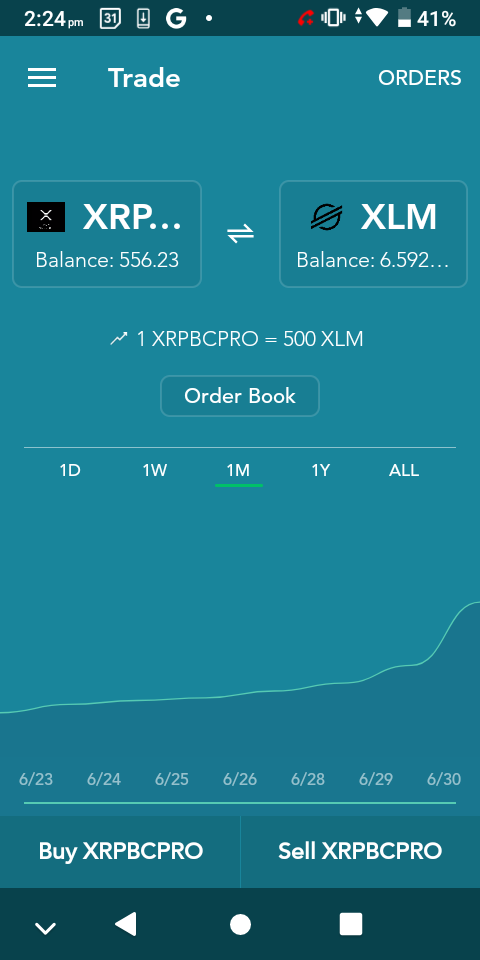

I have released 900 of the QFS coins to XRP Billionaires Club PRO already! We are buying up big chinks of this future global retail network at the price of 10M coins for 1 xlm!

NEW COINS IS THE ONLY PLACE THE PROFITS ARE NOW! JOIN PRO GROUP! I HAVE MADE $80k ON 4 OF MY NEW COINS IN UNDER 8 HOURS.. I INVESTED $5 ON EACH COIN! ..and I bought some of all 1200-1300 of them!

I give you 1 XRPBCPRO token valued at 400 xlm (USD$112) for joining the PRO groups! .. and you get access to the $108M XRP Billionaires Club Members Benefit Fund for your future projects. You must hold XRPBCPRO to vote on the allocation of this fund! I have 972 tokens left for new members with full voting rights!

1000 tokens will be sold to add benefit to XRP Billionaires Club PRO Patreons. Our pricing is locked into a structure that can not be changed and will continue for the life of the token. The available supply of tokens for sale is limited to 5% of total at any one time.

Stellar Protocol 18: LIQUIDITY!

This enables us to stake our XRPBCPRO Member Benefits Fund, and immediately start earning money for the fund to allocate to projects..

Our Member Benefits Fund will earn 0.3% on the staking. Which comes to $540K… per day! We can do a lot to help our members with that much money!

XRP Billionaires Club Members Benefit Fund after 5 days!